CFO and Finance Department: The Perfect Starting Point to Leverage Blockchain Technology to Improve Financial

Authors: Prof. Dr. Philipp Sandner, Dr. Stefan E. Gros, Philipp Schulden and Jonas Groß

Blockchain technology promises to change almost everything related to finance. For corporations in a B2B context, crypto currencies such as Bitcoin or IOTA do not play a significant role. Corporations will see the true potential of blockchain technology once the Euro is running „on-chain“. The finance department in traditional industrial companies, with the CFO leading the way, has a unique opportunity to accelerate digital transformation. The reason is simple: Blockchain can improve the CFO’s key performance metrics. Naturally, CFOs should therefore have a strong incentive to leverage blockchain and DLT to improve their KPIs and, thus, to achieve their goals.

The finance department of a company is concerned, for example, with the short-term financing of the operational business or the long-term financing of strategic projects. The finance department and the CFO are rarely perceived as innovative, but they are the ones who can advance and facilitate a meaningful application of blockchain technology.

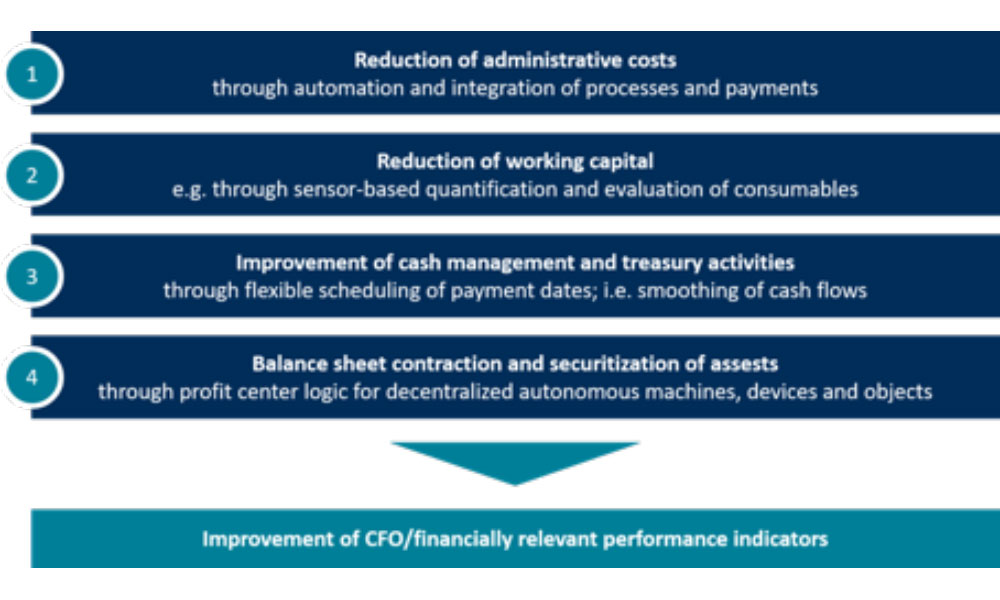

The CFO as an innovation manager? The finance department as an innovation lab? At the outset, this does not sound like a good fit. However, blockchain technology provides unexpected opportunities for the CFO – with the necessary requirement that he or she is IT-/tech-affine. This enables the CFO to systematically improve his key performance indicators and, therefore, to achieve corporate goals. Figure 1 summarizes the potential benefits of blockchain technology for the finance department.

Capitalization of assets on the balance sheet

Benefits arising from the capitalization of assets on the balance sheet can be illustrated by the example of a well-known German chemical company: This chemical company operates an R&D department in which new chemicals and process technologies are investigated. Yet, at this company the blockchain activities and the use of sensors are mainly driven by the finance department. The aim is to leverage sensor technology to measure silos filled with valuable chemicals. This is done with the intention that – if the filling level can be measured – invoicing processes can be carried out completely automatically and thus more efficiently. Also, in case silos and their content can be measured with sensors, capitalization on the balance sheet would be possible. The highly precise measurement of the stock can improve working capital metrics. That is, of course, a CFO domain.

Reduction of administrative costs

In first projects, silos are integrated into a blockchain network to allow the silo to directly execute payment transactions. If a customer consumes chemicals from the silo, the silo could directly and automatically send an invoice, generate an accounting recordand, above all, monitor incoming payments – without the intervention of a accounting department. But if we think further, a fine-grained profit center logic could be achieved in the future – based on decentralized automation of machines that are independently integrated into payment transactions. This again is a CFO domain, as the administrative costs per accounting process can be reduced. In addition, such an architecture will enable a decentralized governance of an organization in the future

Integration of financial services such as leasing, factoring, etc.

The integration of financial services such as leasing, factoring, etc. on the silo-level would also be possible. In this case, a blockchain is required because this technology allows machines to be directly integrated into payment networks. Thus, the Euro can be used as a unit of account, making it easily accessible and „programmable“ by machines. This enables the transfer of money on a blockchain-basis in Euro but only if the Euro is running on said blockchain network. This potential is further expanded if payments are integrated with business logics. In other words, processes as well as payment transactions can be „programmed“. We know such „programmable money“ from today’s world in the form of leasing contracts, financing models, interest payments, factoring solutions, etc. – all these processes can easily be programmed on a blockchain basis. Again, the requirement for this is to have the Euro running on a blockchain system.

Most importantly, these processes can be directly interfaced with machines. It is unknown whether the chemical company we have mentioned before is pursuing these further considerations. But what would happen if silos themselves could participate in factoring processes? In such cases, the silo itself decides when the invoiced amount should be received. This would require a blockchain-based capital market in the background to provide and execute this type of financing. What may sound utopian can be summarized using the emerging catchword of „Decentralized Finance“. This again would be a CFO domain, as it could (and should) completely redefine the topic of the treasury department. Large parts of the treasury functions, such as the provision of liquidity at a precisely scheduled moment or the calculation of interest rates will be enabled by the blockchain-based smart contracts and will be carried out fully automatically by algorithms.

Balance sheet contraction and securitization of capital goods on the capital market

Furthermore, it becomes interesting considering the above-mentioned aspects in combination: A sensor measuring the filling level enables a single silo to be organized as a profit center. This, in turn, allows the calculation of a return on invested capital – silo by silo. Fundamentally, a silo can thus be securitized as an individual asset on the capital market and converted to an investment target for investors. However, in today’s financial market structures, the cost of legal structuring is too high if single silos should be securitized. This is exactly what the blockchain technology will change in the near future, assuming the applicable legal regulations are adapted. The latter is being done in Liechtenstein where the new Blockchain Act will come into force in January 2020. This future-oriented legal framework could turn all these visions into reality from 2020 onwards thanks to Liechtenstein’s brillant legal regulations for blockchain-based tokens. Liechtenstein is a small country; but other countries are also in the process of adapting their legislation in a similar vein. Germany and Switzerland, by the way, play a leading role in Europe.

Back to the silo, which is structured as a profit center such that the calculation of a silo specific return on investment becomes possible. The setup costs for securitizing such assets – known in the blockchain world as tokenization – will dramatically decrease in the coming years. This might open up the possibility that capital goods can be removed from the balance sheet in the future and can be directly securitized on a „blockchain-based capital market“. This, again, is a future CFO domain.

Applicability to a variety of capital goods such as machinery, trucks, etc.

Some of the ideas presented above are based on real experiments aiming to reduce administrative costs. Some aspects presented above are logical conclusions how these experiments could be further developed as soon as the Euro runs on a blockchain network. It can be anticipated that this will be possible from the end of 2019 or the beginning of 2020: Azhos, a startup from Liechtenstein, uses sensor and telemetry technology to integrate silos into blockchain systems; they leverage the „Euro on blockchain“ to integrate machines directly into the capital market.

Weeve, a startup from Berlin, connects machines with blockchain systems in a secure way by using a crypto computer chip. In addition, Bosch is already preparing its sensors to be integrated into blockchain networks. Automotive companies are also partially active in the blockchain sector: An exciting experiment is an approach introduced in 2017 of connecting trucks to a blockchain network with the goal to expand leasing volumes for commercial vehicles. Again, the truck could become a singular profit center, which monitors incoming leasing proceeds. If the leasing payments stop arriving – for example due to fraudulent behavior on the part of the logistics company leasing the truck – the truck would no longer restart after the next refueling. The idea described above of integrating things and machines into a blockchain network, which requires the Euro „on-chain“ also applies here. This, in turn, concerns immediate payment transactions as such but also more complex flows of money (i.e., smart contracts) such as leasing, factoring, financing, etc.

Blockchain and finance

Blockchain technology will change many things that are related to finance. This first concerns traditional business models of the financial sector such as banks and stock exchanges. However, the scope of blockchain technology extends far beyond this. What started with cryptocurrencies such as Bitcoin and Ethereum is now continuing with considerations such as deploying securities (i.e, stocks, loans) on a blockchain network or even deploying traditional currencies such as the Euro “on chain”. It is important to understand that blockchain technology offers an outstanding possibility to digitally implement all kinds of financial processes perfectly synced with products and services. Anything that is kept in registers is basically suitable for managed by a blockchain system. If a currency such as the Euro is represented on a blockchain basis, numerous advantages emerge.

The Euro on the blockchain

The Euro on the blockchain will be very important for the German industry (e.g. engineering, mobility): Companies denominate their invoices in Euro and also their accounting systems operate in Euro. A world in which BMW, for example, sends an invoice in Bitcoin is at this point in time not imaginable. Bitcoin’s general acceptance as a means of payment is too low and both volatility and regulatory hurdles are too high.

“Euro on blockchain” means that a blockchain network would be used to technically organize balances of (bank) accounts. On the contrary, one could argue that blockchain technology is not necessary for such a digital Euro. However, people arguing in this way might have not fully understood the technology.

Below we outline three key reasons why blockchain technology will sooner or later be the technological basis for the digital Euro. It is clear that the 10-year-old Bitcoin blockchain appears to be technologically outdated for several reasons. However, in this article, the word “blockchain” is used as “blockchain in a broader sense” and actually refers to DLT systems that were inspired by blockchain technology and share some common technical features with the “original blockchain” of Bitcoin.

1. Machine Economy

It is estimated that more than 20 billion devices will be connected to the Internet by 2025 — nearly three times as many devices as people currently living on the planet. Some of these devices will sooner or later also be integrated into a payment network. Blockchain technology is best suited for equipping millions of devices with a computer chip and therefore with an own wallet. Then, a device can receive payments (revenues) and transfer money (costs). It is reasonable to argue that such transfers of funds will be conducted in Euro since then accounting systems would then not have to be changed. Additionally, there would not be any exchange rate risks.

For these millions of devices, blockchain technology can easily provide the opportunity to participate in a payment network and integrate them into automated business processes (i.e. through smart contracts). This requires the Euro on the blockchain.

Technologically speaking, blockchain systems must, of course, be further developed to increase transaction speed. Assuming the technological development of recent years for the future, however, this should not be a “dealbreaker”. Also, the increasing storage capacity due to redundant data is uncritical if one considers that an autonomous car will soon generate hundreds of gigabytes of data. Per day. Per car.

Euro as a token

The Euro represents value — similar to stocks, real estate, and other assets. Today, for example, there are IT systems processing Euro transactions and other IT systems for securities trading. In the financial system of the future, both silo-like IT systems will merge into integrated platforms. They will be based on a blockchain-based infrastructure, on which the Euro is listed as well as various stocks, securities, and numerous other assets. All these assets are tokens on “integrated” blockchain systems. Then, trading across tokens happens such as buying a Daimler stock for Euro. Payment versus delivery then takes place at the same time. Assets no longer have to be transferred or matched between silo-like IT systems. We think that blockchain systems are best suited to map different types of assets (i.e., tokens) in an integrated way without creating new silo-like structures.

Smart contracts

Actually, the whole discussion is not solely concerning pure direct transactions. Rather, integrating payment into a business logic or a business process in a seamless key will be important. Examples are escrow accounts, interest payments, factoring, leasing, loans, etc. — such processes can ideally be automated and “programmed” with smart contracts. Today, there are various process interruptions and inconsistent interfaces in existing processes and IT systems. Euro-denoted smart contracts can improve this and can enable better, faster and more efficient processes. Therefore, smart contracts have to be an integral part of advanced blockchain systems.

Next steps

Some companies are already issuing Euro on a blockchain system or will soon offer Euro on a blockchain basis. Commerzbank has already conducted transactions based on a blockchain-based Euro; these transactions have conducted in compliance with all regulatory requirements and will be part of the bank’s balance sheet — proving that it has been real money. The German startup Cash on Ledger offers Euro-denominated smart contracts for the implementation of the first projects. The Frankfurt-based startup Finbc processes invoices with a blockchain-based Euro and will soon offer this service. Monerium, an Iceland-based startup, soon offers the Euro and other currencies on the public Ethereum network. Stasis, a startup located in Malta, also offers a Euro-denominated token on Ethereum. Fnality International — a project in which also German banks are involved — will soon offer the blockchain Euro for money transfers between banks. These projects are the reality and they work. Further similar projects have been announced, for example, by the US bank JP Morgan or the DAX company Allianz.

Conclusion

Blockchain is not an end in itself, but rather facilitates the improvement of numerous performance indicators that are relevant for the CFO. Successful experiments by industrial companies prove that these approaches work – especially when they are initiated by the finance department. This requires openness, technical expertise, and sufficient budget. Furthermore, the overriding trend is discernible: In the coming years, the topic of „finance“ will move away from traditional companies operating in the financial sector – and in the direction of a blockchain-based infrastructure and towards industrial companies.

Authors

Prof. Dr. Philipp Sandner is head of the Frankfurt School Blockchain Center (FSBC) at the Frankfurt School of Finance & Management. In 2018, he was ranked as one of the “Top 30” economists by the Frankfurter Allgemeine Zeitung (FAZ), a major newspaper in Germany. Further, he belongs to the “Top 40 under 40” — a ranking by the German business magazine Capital. The expertise of Prof. Sandner in particular includes blockchain technology, crypto assets, distributed ledger technology (DLT), Euro-on-Ledger, initial coin offerings (ICOs), security tokens (STOs), digital transformation and entrepreneurship.

Dr. Stefan E. Gros is a senior Chief Financial Officer and Interim Transformation Officer for family owned, listed and private equity held corporates. He has a strong reputation for helping companies to grow, to transform or restructure. Digital is conHe is lecturer for Business Valuation and Digitization at the Catholic University Ingolstadt. Currently he serves as an executive board member of an international, privately held corporation with focus on M&A, Business Transformation and Growth Management.

Philipp Schulden is chief operations officer of the Frankfurt School Blockchain Center at the Frankfurt School of Finance & Management. In the blockchain environment, he has supervised numerous international projects and research initiatives. He also possesses expertise in the field of application possibilities of blockchain technology in the area of the Industry 4.0. He completed his studies in Management (M.Sc.) in Germany, Russia, Peru and South Korea.

Jonas Groß is a project manager and research assistant of the Frankfurt School Blockchain Center (FSBC). His fields of interests are primarily crypto currencies. Besides, in the context of his PhD he analyzes the impact of blockchain technology on monetary policy of worldwide central banks. He mainly studies innovations as central bank digital currencies (CBDC) and central bank crypto currencies (CBCC).

Beitrag im Netzwerk teilen: